Report Scope & Publication Details

- Last updated: January 2026

- Data cut-off: December 2025

- Coverage geography: EU-27 + UK

- Forecast period: 2026–2030

- Delivery format + delivery time: PDF + Excel (delivery within 24 hours of purchase)

- Update policy: 12-month major-policy mini-update (ETS/IED/waste policy items that move economics)

- Analyst access (Q&A): 20-minute buyer Q&A call

- Who this is for: Strategy & corp dev teams, EPCs, OEMs, infra investors, lenders.

Above-the-Fold Snapshot

- WtE in Europe is not power generation; underwriting tu s on heat offtake durability, gate fee structure, and residue outlets, with electricity increasingly a secondary value line.

- The market is moving into an auditability phase: emissions MRV requirements and permit transparency are tightening the range of bankable assumptions.

- Where models break: teams often treat feedstock as stable; in practice, collection reforms, recycling performance, and RDF quality change net calorific value and operating margin.

- The next five years are shaped by policy mechanics (MRV/IED/data portals) more than technology hype.

Market Overview

The EU Waste-to-Energy Market is entering a phase where value shifts from “capacity” to contracted, auditable cashflow. Between 2026 and 2030, the differentiator is not whether a plant can bu residual waste, but whether it can do so within tightening permit expectations, with resilient heat offtake and a residue strategy that survives scrutiny. The market is also becoming easier to diligence on paper and harder to execute on the ground: more reporting, more visibility, and less tolerance for weak assumptions.

The Europe waste to energy market size was estimated at USD 15.18 billion in 2025 and is anticipated to grow at a compound annual growth rate (CAGR) of 12.14% from 2026 to 2030. The market is projected to grow significantly owing to the growing distress about GHG emissions and new EU regulations to decrease carbon footprint. Growing environmental conce s and climate change have led various countries around the world to take steps to reduce their carbon footprint from the industrial sector and opt for waste to energy technology.

Execution friction sits in three places: (1) permit conditions and community/legal exposure, (2) heat network/offtake delivery and pricing, and (3) feedstock composition drift and residue outlets. Capital is moving towards assets with visible heat anchors and municipal contracting depth, and away from merchant assumptions that look neat in Excel but fail under operational variance.

If you only change one assumption in your model, change: heat offtake reliability and pricing gove ance, not the headline gate fee. That single shift typically dominates DSCR comfort when the plant is CHP-linked or heat-led.

Why do forecasts go wrong in the EU Waste-to-Energy Market?

Forecasts usually fail because they treat three variables as stable when they are not: (1) residual waste quality, (2) heat offtake, and (3) regulatory operating envelope. Collection reforms and recycling performance change the composition of what remains, which alters calorific value and maintenance burden. Heat offtake looks contracted, but real delivery depends on network build-outs, temperature requirements, and seasonal dispatch priorities. Finally, tightening permit expectations and increased reporting visibility push assets into compliance-led capex and operating discipline. The miss shows up as lower net output, higher reagent/maintenance costs, and weaker DSCR headroom.

Where do WtE projects fail in reality, even when diligence looks clean?

They fail at interfaces: permit-to-operations, plant-to-heat network, and waste system-to-feedstock bunker. Permit conditions tighten after public scrutiny, forcing retrofits, operating constraints, or extended commissioning. Heat networks are infrastructure projects with their own delays and gove ance issues; when they slip, the plant loses its highest-quality revenue line and becomes power-led at worse economics. Feedstock contracts specify tonnage, but composition drift increases corrosion, residue handling costs, and downtime. The failure patte shows up as prolonged ramp-up, unplanned outages, and covenant discomfort tied to availability and heat delivery.

How an IC team screens this market

- Underwrite to cashflow visibility, not headline capacity.

- Stress-test heat offtake: network readiness, pricing gove ance, dispatch priority, seasonal load.

- Validate feedstock beyond volume: composition risk, RDF quality control, contract enforceability.

- Map permit fragility: local opposition, litigation risk, tightened conditions, data transparency exposure.

- Separate revenue stack lines: gate fees vs power vs heat vs metals, then stress each.

- Test capex/opex sensitivity to compliance: reagents, monitoring, residue outlets, outages.

- For banks: focus on availability ramp and downside DSCR under “heat shortfall” scenario.

Demand-Supply Insights

Short-term demand remains robust due to EU landfill diversion targets (≤10% by 2035) and net-zero commitments, with rising municipal solid waste volumes and limited landfill capacity driving WtE adoption. In 2025, thermal technologies (incineration dominant) hold ~60% share, while biological processes (anaerobic digestion) grow fastest at ~12% CAGR through 2030, supported by biomethane goals. Supply is expanding via new facilities and retrofits, with ~4,921 MW installed renewable municipal waste capacity in Europe (2024 peak, up from prior years). Capacity additions focus on integrated CHP (combined heat & power) and district heating, especially in Nordics and Germany (27.5% market share in 2024). Recent examples include Greece's USD 1.15B investment in six projects (1.19M tons/year processing) and Slovakia's Kosice facility (100,000 tons/year). Grid integration improves utilization, though public opposition and permitting delays persist in some regions. Overall, supply meets demand via scale-ups in large plants (>750 tpd) and modular tech for efficiency.

Pricing and Costs

Incineration remains cost-competitive, with operational efficiencies boosted by advanced flue-gas cleaning and heat recovery. High capital costs for new plants (e.g., retrofits for carbon capture) are offset by rising landfill gate fees, carbon incentives (e.g., EU CBAM), and stable revenues from district heating. Biological routes benefit from biomethane credits. Costs are moderated by technological advancements (e.g., high-efficiency boilers), though stricter emissions rules (dioxin caps in Germany) increase compliance expenses. Project economics improve with scale and public-private partnerships.

Investment Landscape

The sector attracts significant funding amid € trillions needed for EU energy transition to 2050. Recent deals highlight momentum: e.g., SUEZ's EUR 1.4B Toulouse concession (580 GWh/year), UK Portland facility permit, and EBRD-backed projects in Easte Europe. Private equity and utilities Favor CHP/district heating (13.5% CAGR to 2030) and biological solutions (from USD 5.4B in 2025 to USD 8.2B by 2030). De-risked assets with stable offtake (heat/electricity PPAs) draw investors, with EU Innovation Fund and green bonds supporting CCUS integration. Germany leads with urbanization and coal exits creating baseload demand.

Execution and New Rails

Permitting streamlined in some areas via EU directives, but local opposition (e.g., Madrid/Amsterdam) and emissions scrutiny extend timelines. Emerging revenues stem from 24/7 carbon-free solutions, biomethane/hydrogen linkage, and district heating (e.g., Hamburg's Borsigstraße project). Advanced trends include AI/IoT optimization, hybrid renewable integration, and carbon capture (e.g., Filbo averket in Sweden). Circular models prioritize recycling upstream, with WtE as residual solution.

This updated overview reflects a resilient, policy-supported market transitioning toward low-carbon, integrated energy recovery. For deeper dives, Mordor Intelligence (2025–2030 forecast) and Global Market Insights (5.8% CAGR to 2034) provide leading benchmarks.

the European installed base of renewable municipal waste energy capacity stands at approximately 4,921 MW (peaking in 2024, with modest net additions expected through 2030 due to focus on retrofits, efficiency upgrades, and integration with carbon capture rather than massive new builds). Installed base reaches ~5,500–6,000 MW by 2030 at a CAGR of ~2–3% (conservative growth amid strong recycling priorities and limited new greenfield plants).

- Thermal (incineration/grate combustion dominant) leads with ~60% revenue share in 2024–2025, supported by established large-scale fleets (>750 tpd) in Germany (leading with ~1,004 MW), UK, Sweden, and Nordics.

- Biological (anaerobic digestion) scales fastest at ~12.2% CAGR through 2030, driven by REPowerEU biomethane targets (35 bcm by 2030), agricultural residues, and low-carbon gas incentives; biological-linked market projected from USD 5.4 billion in 2025 to USD 8.2 billion by 2030.

- Utility-scale/large plants dominate overall capacity and revenue (~57% share for utilities/IPPs), while district heating operators post the fastest end-user CAGR (~13.5%) via CHP integration in urban/Nordic networks.

Policy levers include EEG 2023 amendments (Germany), EU Net Zero Industry Act (boosting capture-ready designs), Federal Hydrogen Strategy synergies, EU Green Taxonomy incentives for high-efficiency retrofits/CCUS, and landfill diversion mandates (≤10% by 2035).

Risks include curtailment/public opposition in densely populated/southe regions, BOS/compliance cost creep from stricter emissions rules (e.g., dioxin caps), permitting drag (local resistance in cities like Madrid/Amsterdam), and competition from advanced recycling upstream—modeled in conservative risk bands with slower capacity growth than revenue (focus on efficiency/retrofits over volume additions).

This reflects a mature, policy-resilient market shifting toward low-carbon integration (e.g., CCUS pilots like Filbo averket in Sweden), biomethane linkage, and district heating (e.g., Hamburg Borsigstraße). Recent additions are modest (e.g., new modular plants in Slovakia/Greece pipelines), with emphasis on retrofits and biological growth over thermal expansion. For benchmarks, Mordor Intelligence (7.38% overall CAGR to USD 27.18B by 2030) and Global Market Insights (5.8% to 2034) highlight revenue resilience despite subdued capacity ramps.

Key Takeaways

- Incineration leads; tandem/perovskite pilots scale fastest 2026–2030.

- Commercial & Industrial Waste dominates capacity; Municipal Solid Waste posts the fastest CAGR.

- Policy levers: EEG 2023 amendments (Germany), EU Net Zero Industry Act

- Risks: curtailment/public opposition in densely populated/southe regions, BOS/compliance cost creep from stricter emissions rules

Drivers & Restraints (Quantified Impact)

Driver Impact Matrix

|

Driver |

~% Impact on CAGR |

Focus Geography |

Timeline |

|

District Heating / CHP Integration & Expansion |

+3.5–4.0% |

Nordics (Sweden, Denmark), Germany, Central-Easte Europe |

2–5 yrs |

|

Landfill Diversion Mandates & Gate Fee Increases |

+2.8-3.2% |

Nationwide (EU-wide, strongest in Germany, Italy, Spain) |

4+ yrs |

|

Biomethane / Biological (Anaerobic Digestion) Growth |

+2.0–2.5% |

Agricultural regions (Nordics, Germany, France, Easte Europe) |

3+ yrs |

|

EU Green Taxonomy & Retrofit Incentives |

+1.5–2.0% |

Germany, France, Nordics |

≤2–4 yrs) |

Restraint Impact Matrix

|

Driver |

~% Impact on CAGR |

Focus Geography |

Timeline |

|

Public Opposition, Permitting Delays & Emissions Scrutiny |

+3.2% |

Densely populated/southe regions (e.g., Italy, Spain, urban Germany) |

≤3 yrs |

|

Competition from Advanced Recycling & Circular Economy Priorities |

-1.2 - 1.5% |

Nationwide, upstream waste sorting |

2-5 yrs |

|

Compliance & Operational Cost Creep |

+2.1% |

Germany (dioxin caps), imports/EPCs |

2-4 yrs |

Full model in the paid report.

Demand Outlook (What Buyers Actually Procure)

- Municipal & District Heating Operators (fastest-growing segment): Prioritize large-scale thermal WtE plants with CHP integration for district heating networks; procure high-efficiency incineration/grate systems delivering both electricity and reliable baseload heat (e.g., steam/hot water for urban/residential supply).

- Utilities & Independent Power Producers (IPPs) (dominant segment): Focus on utility-scale facilities (>750 tpd) for baseload electricity generation (~48% of output in 2024–2025), increasingly bundled with CHP for dual revenue

- Industrial Captive Plants & End-Users: Industrial buyers (e.g., chemical parks like BASF Ludwigshafen) procure refuse-derived fuel (RDF) boilers or captive WtE for on-site steam/heat, offsetting natural gas volatility. Procurement emphasizes biological routes (anaerobic digestion for biomethane) in agro-industrial areas, growing at ~12.2% CAGR aligned with REPowerEU (35 bcm biomethane by 2030). Emerging trends include waste-heat linkage for process needs.

Opportunity Zones & White Space Heatmap

- Municipal utilities expand CHP/district heating concessions (e.g., SUEZ Toulouse: 580 GWh/year).

- Hydrogen developers explore synergies (e.g., Plagazi Gävle project for hydrogen-from-waste).

- Data centers (rising demand) procure waste-generated steam/heat-reuse loops for cooling and sustainability (e.g., Frankfurt/Dublin/Stockholm clusters tapping WtE heat; potential 300 TWh recoverable waste heat by 2030 if integrated).

Segment Snapshots (Concise)

- Thermal (incineration/combustion dominant, with gasification/pyrolysis sub-segments) leads significantly, holding ~60–88% revenue/market share in 2024–2025 (e.g., 60% per Mordor, 88% per GMI).

- It remains the backbone for reliable baseload energy from mixed municipal solid waste, supported by established large plants and CHP integration. Thermal continues to dominate through 2030 due to scale, efficiency in volume reduction (~90%), and compliance with strict EU emissions rules (advanced flue-gas cleaning).

- Biological (primarily anaerobic digestion) is rising fastest at ~7–12.2% CAGR through 2030–2034, driven by organic/wet waste processing (food/agriculture residues), biomethane production, and alignment with circular economy/recycling priorities.

- Emerging advanced variants (e.g., plasma-arc gasification) show niche growth but remain minor compared to core thermal/biological.

Source – Proprietary Research

Country Context (Why Germany is Different)

- EEG and auction design sustain rooftop + utility build-out; interconnection queues drive storage co-deployment.

- Among EU peers, Germany pairs large rooftop base with higher southe curtailment, making digital forecasting + storage more valuable.

Europe Policy Snapshot

|

Policy / Directive |

Key Objectives / Targets |

Timeline / Status (2025–2030) |

Impact on WtE Market |

Geography / Focus Areas |

|

Waste Framework Directive |

Prioritize waste hierarchy, limit landfilling; promote circular economy and separate collection. |

Entered force Oct 2025; ongoing implementation. |

Boosts residual waste diversion to WtE as last-resort recovery; supports biological |

EU-wide; strongest in Easte /Southe Europe for landfill reduction. |

|

Landfill Directive |

Cap municipal waste to landfill at ≤10% by 2035; progressive reduction of biodegradable waste. |

2035 target; early wa ings for at-risk Member States |

Drives municipal solid waste to WtE facilities; rising gate fees enhance WtE economics. |

EU-wide; urgent in high-landfill countries |

|

REPowerEU Plan & Biomethane Industrial Partnership |

Scale sustainable biomethane to 35 bcm/year by 2030; promote biological WtE routes. |

Non-binding but endorsed in RED III/CAP; production ramping |

Accelerates biological WtE at ~12% CAGR; synergies for biomethane from organic/agro waste. |

Agricultural regions (Nordics, Germany, France, Easte Europe). |

|

EU Green Deal & Circular Economy Action Plan |

Achieve climate neutrality by 2050; high recycling; resource efficiency. |

Ongoing; new circular measures Dec 2025 (e.g., plastics). |

Positions WtE as integrated solution for residual waste; favors retrofits/CCUS for low-carbon heat/electricity. |

EU-wide; urban/Nordics for CHP/district heating. |

|

EU Net Zero Industry Act (2024/1735) |

Boost manufacturing of net-zero tech; 40% domestic capacity by 2030. |

In force; guidelines/implementing acts 2025. |

Supports WtE retrofits/CCUS readiness; attracts funding for advanced thermal/biological tech. |

Energy-intensive/industrial sites; synergies with WtE heat/CO₂ capture. |

|

EU Green Taxonomy (ongoing refinements) |

Classify sustainable activities; high-efficiency WtE/retrofits eligible if meeting criteria (e.g., emissions, circularity). |

Delegated Acts applied; simplifications 2025 |

Unlocks green bonds/funding for compliant WtE (CHP, biological, CCUS-ready); excludes high-emission incineration without upgrades. |

EU-wide; favors high-efficiency plants in Germany/Nordics. |

|

Renewable Energy Directive (RED III) & Related |

Promote advanced biofuels/biomethane; higher RED III targets for waste-derived energy. |

In force; sub-targets for Annex IX feedstocks. |

Enhances WtE revenues via biomethane credits; supports waste feedstock in thermal routes. |

Transport/gas grid injection; Germany/Netherlands phasing out double-counting. |

|

Carbon Border Adjustment Mechanism (CBAM) |

Full launch 2026; monetize avoided emissions from WtE displacing fossils. |

2026 onward. |

Premium revenues for low-carbon WtE electricity/heat; improves project bankability. |

EU-wide; industrial/electricity sectors. |

Mini Case Patte

Patte : From diligence to cashflow, where this market surprises teams (120–170 words)

A CHP-linked urban WtE plant is diligenced as “contracted and stable”: residual waste tonnage secured via municipal arrangements, heat sold into a district heating network, and power exported under standard market exposure. Execution diverges quickly. The district heating interface lags because network extensions and operating temperatures require additional scope, and dispatch rules prioritise other sources in shoulder seasons. Heat capture drops, so the asset becomes power-led for longer than modelled. At the same time, the residual stream shifts as collection reforms improve recycling and the remaining waste becomes harder on the boiler, increasing downtime and reagent cost. The friction point is the heat gove ance plus feedstock composition clause gap: contracts protected volume, not usable energy quality or heat delivery certainty.

- IC implication: underwrite heat utilisation gove ance and composition drift stress tests.

- Bank implication: covenant comfort must be tested under “heat shortfall + availability drag”.

- Operator implication: O&M and blending discipline become value, not overhead.

Competitive Landscape

- Market Concentration: Medium to Moderate. Large conglomerates dominated through record order books and retrofits.

- Who’s gaining: Players pairing secured permits + CHP/district heating integration + stable PPAs/tipping fees lead momentum, as district heating operators grow fastest (~13.5% CAGR) and utilities/IPPs hold ~57% share.

- Leader Active in this space: Veolia Environnement SA, SUEZ, Martin GmbH, EnBW, RWE AG, STEAG Energy Services GmbH / Iqony GmbH (full profiles & ranks inside)

The sector benefits from stringent EU directives reducing landfill use and promoting thermal and biological WtE technologies, with major players like Veolia, Hitachi Zosen, and Mitsubishi Heavy Industries leading through infrastructure and innovation. Germany, UK, France, and emerging markets like Poland and Estonia show strong growth potential, bolstered by coal phase-outs redirecting capital to dispatchable WtE plants. Challenges include high upfront costs, but policy support ensures positive long-term expansion.

Strategy patte table

|

Winning play |

Who uses it (archetype) |

Why it works |

Where it fails |

What signal to watch |

|

Heat-first operating model |

Municipal operator + heat-network partner |

Tu s revenue stack into contracted capture |

Network delays, weak dispatch priority |

Heat utilisation variance vs plan |

|

Feedstock QC and blending gove ance |

Operator with strong waste-system interfaces |

Protects availability and reagent cost |

Poor enforcement of upstream sorting |

Rising unplanned outage frequency |

|

Conservative availability-led design |

EPC + lender-aligned delivery teams |

Reduces ramp-up and LD exposure |

Overbuilt capex without cashflow upside |

Commissioning duration bands |

|

Residue value optimisation |

Operators in tight residue regimes |

Adds margin and reduces compliance risk |

Unsecured outlets or policy shifts |

Residue outlet concentration risk |

|

Contract re-papering at refinancing |

IC-led owners |

Prices reality into indexation/clauses |

Counterparty resistance |

Contract amendment success rate |

Key M&A and PE Deals

- Recent transactions highlight consolidation in waste management with WtE elements:

- INVL Private Equity Fund II acquired 75% of Estonia's largest waste group, Eesti Keskkonnateenused (EKT), in late 2025 (EUR 77 million revenue in 2024), to expand incineration and recycling capacity.

- EQT Infrastructure-backed Arcwood acquired ERG Environmental, strengthening European waste operations.

- Activity remains selective amid broader energy M&A stability, focusing on circular economy leaders.

Major Funding and Gove ment Support - EU programs drive investments:

- RWE's FUREC project (Netherlands) received €108 million from the EU Innovation Fund for waste-to-hydrogen plants processing 700,000 tonnes MSW annually.

- Greece allocated up to €800 million in EU NSRF funding (deadline mid-2026) for six WtE plants totalling €1.15 billion investment and 1.19 million tonnes capacity.

EU LIFE Programme announced €86 million in 2025 for climate projects, with broader Innovation Fund support (€38 billion total 2020-2030) for low-carbon WtE tech. Smaller rounds, like Future Greens' €569k (UK grant + equity), target niche conversions.

Recent Developments

- INVL Private Equity Fund II completes acquisition of Estonia's largest waste management group (EKT): In October 2025, the fund finalized the purchase of a 75% stake in EKT, Estonia's leading waste handler with EUR 77 million revenue, enhancing WtE incineration and recycling amid Baltic market growth.

- Spain launches €50 million RENOCogen scheme for waste treatment plants: Announced January 2026, this funding supports operators replacing fossil fuels with renewables like biogas in cogeneration and waste facilities, covering up to 65% of costs.

- New EU ETS rules effective January 2026: The system expands to include maritime CH₄ and N₂O emissions, with a tightened cap (27 million fewer allowances), reinforcing WtE's role in emissions compliance and energy recovery.

- EU funding advances Gdańsk WtE plant: In April 2025, EU grants supported the new facility in Poland, boosting Easte Europe's WtE capacity amid investments in biogas and MSW processing

Methodology

Europe Waste-to-Energy (WtE) market methodology focuses on installed thermal capacity (GWth equivalent), using 2024 as the base year with forecasts to 2030. It employs a hybrid top-down/bottom-up approach, integrating EU waste directives, auction results, grid interconnection approvals, and feed-in tariffs/strike prices for energy recovery projects.

Data Sources

Primary inputs include developer announcements (e.g., Veolia, RWE), regulator filings (national energy agencies), and ESWET reports on combustion/biogas tech deployment. Module costs draw from ASPs for incinerators and anaerobic digesters, adjusted via lea ing curves (2-4% annual efficiency gains) and capex/WACC ranges (EUR 3-5M/MWth, 6-8% discount)

Full methods & assumptions (PDF) in the purchased report.

- Report Scope

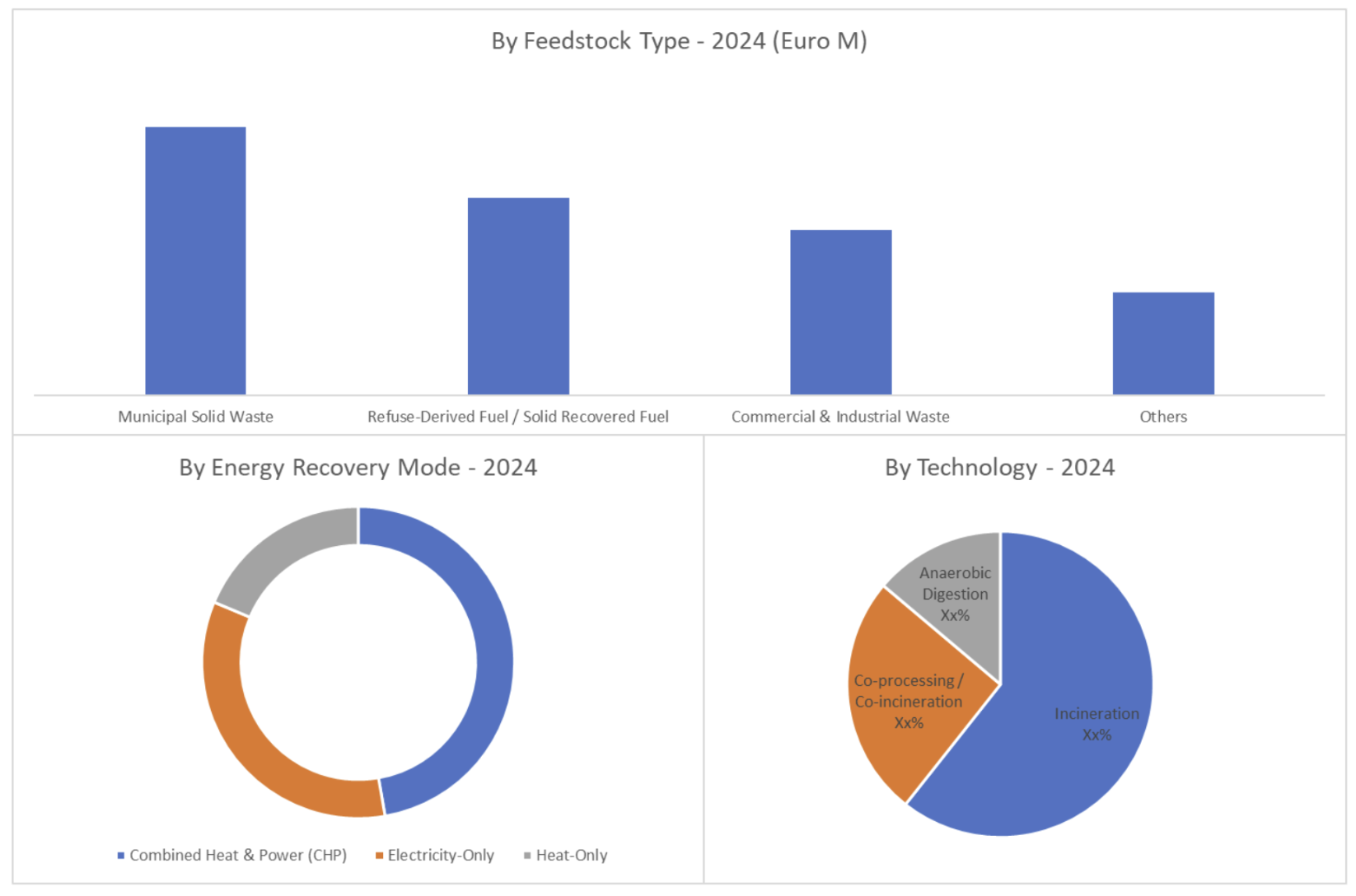

- By Technology Pathway: Incineration (Mass-Bu / Grate), Co-processing / Co-incineration (Cement Kilns & Industrial Fu aces), Anaerobic Digestion (Biogas / Biomethane), Others (Gasification, Pyrolysis, Plasma, Landfill Gas-to-Energy, Other Emerging Routes)

- By Feedback Type: Municipal Solid Waste (MSW) – Residual / Mixed, Refuse-Derived Fuel / Solid Recovered Fuel (RDF/SRF), Commercial & Industrial Waste (C&I), others

- By Energy Recovery Mode: Combined Heat & Power (CHP), Electricity-Only, Heat-Only (District / Industrial Heat), Others

- By Plant Side: Large Centralised Facilities (Metropolitan / National Hubs), Mid-Scale Regional Facilities, Small / Modular / Distributed Systems & Others

- By Geography: Weste Europe (Germany, France, Netherlands, Belgium), Northe Europe (Sweden, Denmark, Finland, Ireland), Southe Europe (Italy, Spain, Portugal, Greece), Central & Easte Europe (Poland, Czechia, Hungary, Romania), & Others (Austria, Switzerland, Slovakia, Bulgaria, Croatia, Baltics, Other EU Countries)

Why This Reality Pack Exists

Generic syndicated reports are optimised to be broad, not to be underwritten. They often blend geographies, smooth over execution friction, and present “market growth” without showing what breaks DSCR in practice. This pack exists to correct that: it treats WtE as a contracted infrastructure asset with interfaces that fail, and it shows how those failures show up in cashflow. For teams making investment, lending, EPC, OEM, or operating decisions, this investment is rational if it prevents one wrong assumption on heat, permitting, or feedstock quality from entering your model.

Key Insights:

- Heat utilisation gove ance, not capacity, is the fastest way to re-rank bankability.

- Feedstock “volume contracted” is weaker than feedstock “quality gove ed” in explaining availability variance.

- Permit transparency compresses the range of defensible assumptions and raises compliance discipline value.

- MRV requirements already change diligence checklists, even before any carbon-cost pathway is priced.

- Residue outlet strategy is a recurring hidden constraint, not a back-office detail.

- Power-led underwriting is a common source of quiet underperformance when heat delivery slips.

- Retrofits often dominate value creation because they target availability and heat capture directly.

- Execution failures cluster at interfaces: plant-to-network, waste system-to-bunker, permit-to-operations.

- Competitive advantage is operational and contractual, not technology novelty.

- Country-level narratives mislead unless tied to permitting and heat infrastructure realities.

FAQs

- What is driving the growth of the Waste-to-Energy market in Europe?

The market is primarily driven by strict EU landfill regulations, circular economy goals, increasing urban waste generation, and the need for reliable renewable energy sources. Policies such as the EU Landfill Directive and Fit for 55 package encourage energy recovery from non-recyclable waste.

- Which Waste-to-Energy technologies are most commonly used in Europe?

Incineration with energy recovery is the dominant technology, followed by anaerobic digestion and gasification. Advanced thermal technologies and CHP (combined heat and power) systems are widely adopted to maximize efficiency and reduce emissions.

- How does Waste-to-Energy support Europe’s circular economy objectives?

WtE helps manage residual waste that cannot be economically recycled, reduces landfill dependency, recovers energy, and enables material recovery such as metals from bottom ash—aligning with Europe’s waste hierarchy and sustainability goals.

- What are the key environmental conce s associated with Waste-to-Energy plants in Europe?

Key conce s include air emissions, ash disposal, and public acceptance. However, mode European WtE facilities use advanced flue-gas cleaning systems and comply with strict Industrial Emissions Directive (IED) standards, significantly minimizing environmental impact.

- Which countries are leading the Waste-to-Energy market in Europe?

Germany, France, the UK, the Netherlands, Sweden, and Denmark are market leaders due to advanced waste management infrastructure, high landfill taxes, and strong policy support for energy recovery.